The Economic Cost of Eliminating Fossil Fuels By Andy May

The debate on how much impact humanity has on climate change continues. As nearly everyone knows by now, there is no observational evidence that humans have a significant impact on climate, so the debate is mostly over which future climate projection is likely. It also isn’t clear that the changes we might cause are bad, most of the evidence suggests that additional CO2 and warming have been beneficial so far and will likely be beneficial in the future. But what if we do decide to eliminate fossil fuels? What is the economic impact?

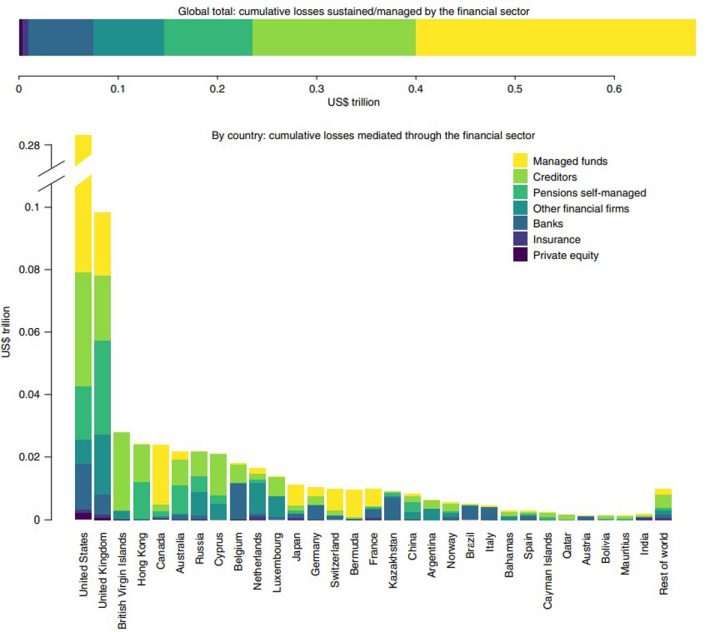

Gregor Semieniuk, and nine co-authors have just published an open-access paper in Nature Climate Change discussing this option. The net present value of future lost fossil fuel profits exceeds $1.4 trillion, with $0.4 trillion lost in the U.S. alone. Compare this to the loss of about $2 trillion in U.S. home value during 2008, according to Zillow, due to the housing crisis. Note the two numbers are not directly comparable, as we are comparing fossil fuel profits to total home value, not homeowner’s equity. Average 2021 U.S. home equity is about $153,000 and the average cost of a home is about $374,900. This ratio reduces the $2 trillion-dollar 2008 loss in home value to a loss of 0.8 trillion in home equity. We could expect a serious economic shock from the loss of oil, gas, and coal assets.

Most of the risk falls on private investors who are overwhelmingly in OECD countries, especially in the U.S. and U.K. To better put this into perspective, the OECD GDP for 2021 was $59 trillion and the U.S. GDP was $21 trillion.

Those that believe that climate change is dangerous want a fast phase-out of fossil fuels, which will necessitate the write-down of fossil fuel assets. The article tracks the ownership of these assets. Once the assets are stranded, who loses? The fossil fuel industry is very large and contains 43,439 oil and gas production assets, not to mention many coal mines. The oil and gas assets are owned by almost 70,000 individual oil and gas companies.

The ultimate owners of these assets are predominantly managed investment funds (whose largest customers are pension funds), banks and other lenders, and self-managed pension funds as shown in Figure 1. The highest losses relative to GDP are in countries where government ownership is significant, as in Russia and Norway.

Discussion

The article claims that compensating the entire loss of the oil and gas companies would “only” cost one to two percent of GDP. However, they do not count the losses of oil and gas service companies or the total resulting unemployment, which is likely more than nine million job losses in the U.S. alone. This does not count the 42,117 jobs in the U.S. coal mining industry.

Suffice it to say their estimate of the cost of curtailing or eliminating fossil fuels is way too low.

As Vaclav Smil makes clear in his new book, oil, gas, and coal underpin all of modern life. Besides energy, they are essential to feed, clothe, and shelter us. He calls ammonia, steel, concrete, and plastics the four pillars of modern civilization, and currently these can only be made with fossil fuels. These four indispensable materials use 17% of the worlds primary energy supply and produce 25% of all CO2 emissions. The IEA reports that 14% of the worlds oil and 8% of the natural gas are used as feedstocks for producing petrochemicals. Further, between 1973 and today the fossil fuel share of energy production has barely decreased at all, and the decrease is nearly entirely due to additional nuclear energy production. If fossil fuels are eliminated, or “phased out” using the euphemism from the article, the result would be catastrophic for the entire world, with nearly unimaginable consequences.

Works Cited

Lomborg, B. (2020, July). Welfare in the 21st century: Increasing development, reducing inequality, the impact of climate change, and the cost of climate policies. Technological Forecasting & Social Change, 156. Retrieved from https://www.sciencedirect.com/science/article/pii/S0040162520304157

Semieniuk, G., Holden, P., Mercure, J., & al., e. (2022, May 26). Stranded fossil-fuel assets translate to major losses for investors in advanced economies. Nature Climate Change. doi:10.1038/s41558-022-01356-y

Smil, V. (2022). How the World Really Works. Viking. Retrieved from https://www.amazon.com/How-World-Really-Works-Science-ebook/dp/B09CDB69WT/ref=sr_1_1?crid=15LL4YNFP77F&keywords=how+the+world+really+works&qid=1653753577&sprefix=How+the+World+Really%2Caps%2C79&sr=8-1

Comments are closed.