David Goldman “China can help US out of its inflation trap.” China appears to be offering a deal to Washington

https://asiatimes.com/2021/06/china-can-help-us-out-of-its-inflation-trap/

NEW YORK – “Goods produced by China’s hundreds of millions of workers are a strong anchor for stabilizing global inflation” read the banner headline at China’s “Observer” (guancha.cn) website June 10, quoting People’s Bank of China official Guo Shuqing, the Communist Party representative at the central bank.

The “Observer” site frequently floats trial balloons for China’s top policymakers.

Guo dismissed the reassurances of Western central bankers and offered an alarming assessment of inflation risk: “Inflation is coming as scheduled. Moreover, the magnitude is higher than the expectations of central bankers in the United States and Europe, and the duration of inflation does not seem to be as short as many experts predict.”

He added, “When fiscal expenditures are already largely supported by the central bank’s printing of money, it is like an airplane entering tailspin, and it is difficult to pull out of the dive. Before 2008, the Fed’s balance sheet was only more than US$800 billion, and now it is nearly $8 trillion, and the ratio of US federal debt to GDP has surpassed the highest record created during World War II.”

Nonetheless, Guo argued, China can help: “For a considerable period of time, China has supplied about half of the world’s finished goods, and on the whole has not increased export prices, laying a solid foundation for global epidemic prevention and control, and for economic recovery. If the large amounts of currency issued by the most developed countries have been the driving force for global inflation, then the goods produced by China’s hundreds of millions of workers are the anchor for stabilizing global inflation.”

Beijing is sending a message to Washington: You have a big problem with inflation, and we can help – in return for other consideration. China and the United States had a tacit deal during the 2000s: You buy our goods, and we invest the proceeds in US Treasury securities. That kept US interest rates artificially low during the housing bubble years.

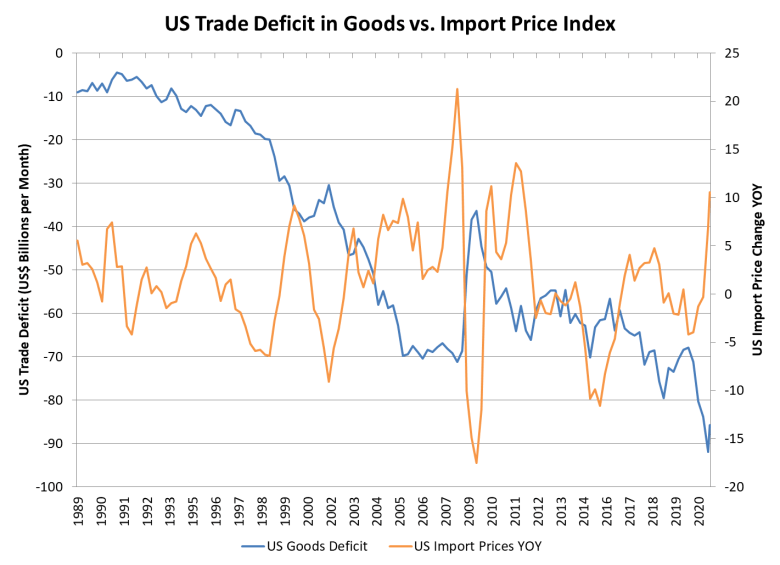

With US core consumer price inflation running at a 10% annual rate during April and May, American economists worry that price hikes for Chinese manufactured goods will add to price momentum during the next couple of years. As William Pesek warned in Asia Times on June 10, “It’s only a matter of time before China exports its surging factory gate inflation.”

Raw materials prices have doubled in the past year, driven by Washington’s unprecedented fiscal and monetary stimulus as much as by recovering demand that was squeezed by the pandemic. Chinese manufacturers want to pass the costs on to their American customers. That could have a big impact on American inflation.

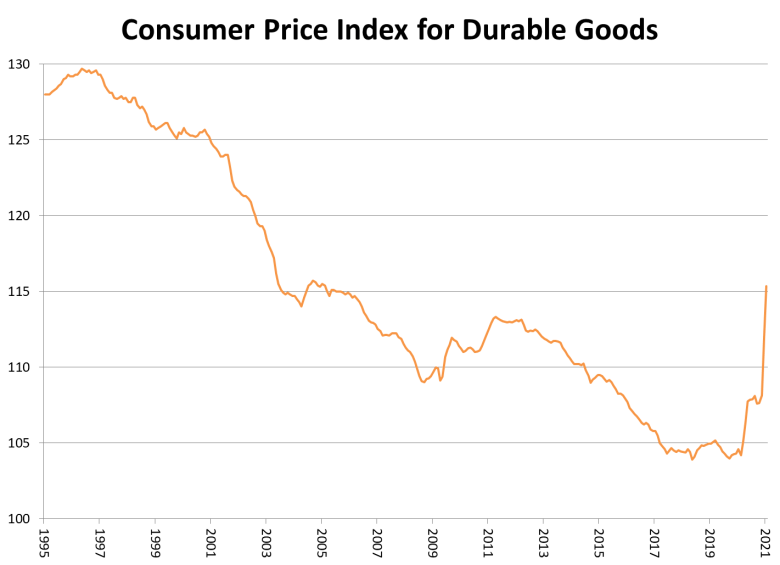

The consumer price index (CPI) for durable goods in the US has fallen steadily since 1998, in large part due to cheap imports from Asia – until 2021, when durable goods prices rose for the first time in more than two decades.

America’s trade balance in goods hit an all-time low in 2021, at an annual rate of about $1 trillion, and imports from China alone comprise about a fifth of all US consumption of manufactured goods.

China’s exports to the US in May 2021 were nearly 20% higher than in May 2019, before the Covid pandemic and despite the punitive Trump tariffs on Chinese goods. China has the only industrial supply chain robust enough to meet the tsunami of demand created by Washington’s $5 trillion of fiscal stimulus.

One possible Chinese response to imported inflation would be to push the price pressures back on the rest of the world. A senior People’s Bank researcher, Liu Jinzhong, wrote on May 21 that China is “an important commodity consumer in the world,” and that “the imported impact from international prices is inevitable.”

Lu proposed that China “let the renminbi [yuan] appreciate appropriately to offset the imported effect.” If China lets its currency rise to dampen imported inflation, it will export the inflation back to the US in the form of higher prices for finished goods.

That’s one possible outcome, but it isn’t necessarily the best one for China. For the past year, the Chinese Communist Party has promulgated “dual circulation,” that is, more emphasis on the domestic consumer market than on exports.

A stronger yuan, to be sure, helps shift consumption to Chinese consumers by lowering local prices for foreign goods and raising overseas prices for Chinese goods.

Household consumption patterns don’t change quickly, though, and a rapid appreciation of the yuan might be disruptive. The yuan already has gained 11% against the US dollar during the past year.

China’s central bank has braked the upward path of the yuan by selling local currency and buying dollars on the foreign exchange market. With a fast-growing trade surplus, China is awash in dollars, and the overhang of US dollar deposits in corporate bank accounts keeps upward pressure on the yuan, as I wrote June 9.

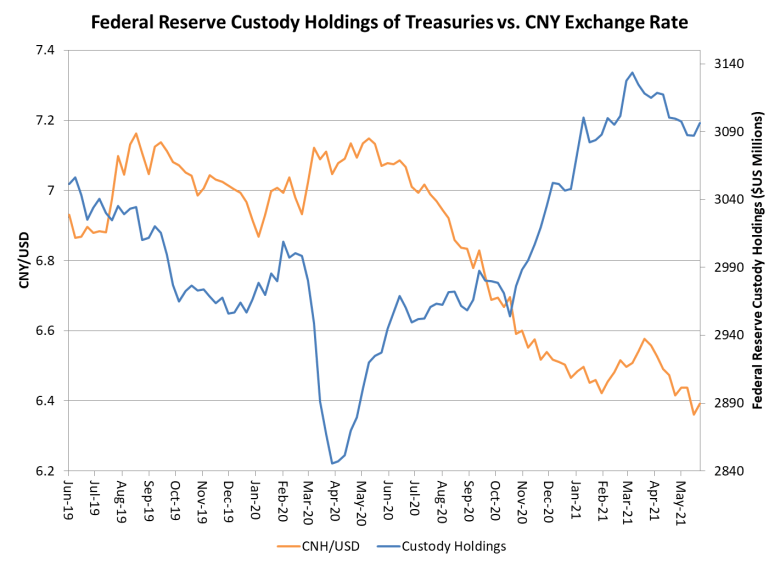

There is compelling evidence that foreign exchange market intervention by the People’s Bank of China (PBOC) has increased China’s holdings of US Treasury securities. When the PBOC buys dollars to support the exchange rate, it typically reinvests those dollars in Treasuries.

The chart below shows a clear inverse relationship between the yuan (CNY) exchange rate and the Fed’s custody holdings of Treasury securities for foreign central banks.

Econometric tests show that lagged changes in the yuan-dollar exchange rate explain most of the change in foreign central bank holdings of Treasuries during the past two years.

The deal that China has floated to Washington is probably this simple: You keep buying our goods, and we keep buying your paper. That way we help you finance the monster budget deficit that the Federal Reserve has been supporting on its own overstretched balance sheet.

We will continue to buy dollars in the foreign exchange market and buy even more Treasuries. In return, you mitigate the Trump administration’s tariffs and sanctions on technology exports.

With President Joe Biden pushing the industrial nations to unite against China at the June 11 Group of Seven meeting in England, neither Beijing nor Washington is likely to make deals of any sort for the time being. The tone of recent ministerial talks between the US and China, though, has been guardedly positive.

US Commerce Secretary Gina Raimondo and her Chinese counterpart Wang Wentao on June 10 “agreed to promote the healthy development of pragmatic cooperation in trade and investment,” the Chinese side stated after the talks.

A week earlier Treasury Secretary Janet Yellen and Chinese Vice Premier Liu He spoke by video call “in an attitude of mutual respect,” according to Chinese media. Taoran Notes, a social media account affiliated with the official Economic Daily newspaper, said the talks “have revealed the same message: pragmatic solution matters most.”

It is far from clear whether Washington will take Beijing up on the offer implied by Guo Shuqing’s June 9 speech. But Washington’s chances of managing an upsurge in inflation without major disruption are vastly greater with China’s cooperation than without it.

Comments are closed.