The Feds Should Tell Every American Exactly What They’re Doing With Our Money Every Year By Kyle Sammin

https://thefederalist.com/2019/04/15/feds-tell-every-american-exactly-theyre-money-every-year/

Congress should require that, within six months of Tax Day, the Internal Revenue Service must issue to all taxpayers a rundown of how much they paid, and what programs it went to fund.

Every April 15, Americans think about taxes. For something that grabs such a large part of our income, federal income taxes should be more prominent in our thoughts. Every day, every hour that you work, a piece of what you earn gets taken by the government before it even gets into your hands.

That is by design, and the withholding system not only guarantees the government the steady revenue it needs to function, but also makes sure that average taxpayers do not spend money that they will need to pay on tax day. The system is important—even necessary—to the functioning of a modern government, but it has one significant downside: people often do not realize how much they pay in taxes every year. That was shown to be especially true after the latest tax law changes: most people paid less in total taxes, but because their refunds may have decreased, they didn’t know it.

Tax withholding is here to stay, but we need a way to remind Americans of what their government costs. To do that, Congress should require that within six months of Tax Day, the Internal Revenue Service must issue to all taxpayers a rundown of how much they paid, and what programs it went to fund. Seeing the figures in black and white will be a shock, and might wake people up to the runaway costs created by our ever-expanding government.

Both Sides Want to Hide Government Spending

Politicians routinely mislead us about which programs drive government spending. When socialist Rep. Alexandria Ocasio-Cortez burst on the scene, one of her major complaints was that defense spending was too high—higher, even, than the military itself even wanted. But entitlement growth, not military spending, has been the major source of our 21st-century deficits.

On the other side of the aisle, some Republican politicians act as though investigating “waste, fraud, and abuse” will balance the budget all on its own. In fact, the vast, vast majority of our spending is on purpose and not fraudulent (whether it is wasteful is a matter of opinion).

Is it any wonder, then, that average Americans do know what their tax dollars are being spent on? In 2017, the IRS collected $1,838,403,489,000 in individual income tax and a further $1,123,473,137,000 in payroll taxes. That’s nearly $3 trillion in revenue, and most of us have no solid idea where it goes.

Part of the problem is politicians only giving us part of the story, and part is that the numbers are so big that they seem to be in world apart from people’s everyday financial calculations. The federal government releases all of these figures every year, but they could do more to make them understandable and easier to access.

Say Yes to Transparency in Government

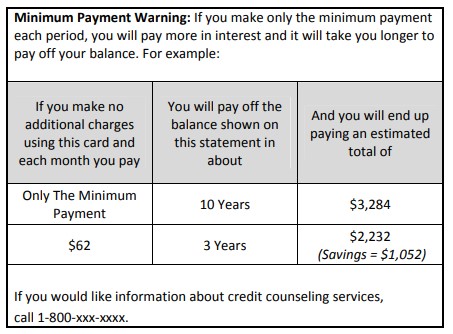

One way of better disseminating this information can be found in the structures of the Credit CARD Act of 2009. There were many facets to that act, which regulated credit card companies, but the most noticeable to consumers was the disclosure it requires on all of our credit card statements. You’ve probably seen it a bunch of times since then. The government’s sample version (found here at p. 67) is shown below:

The point is not to give the customer a ton of new information. Everything here was available before, although you had to do the math yourself. What the standardized disclosure does is present that information in a way that is easy to understand.

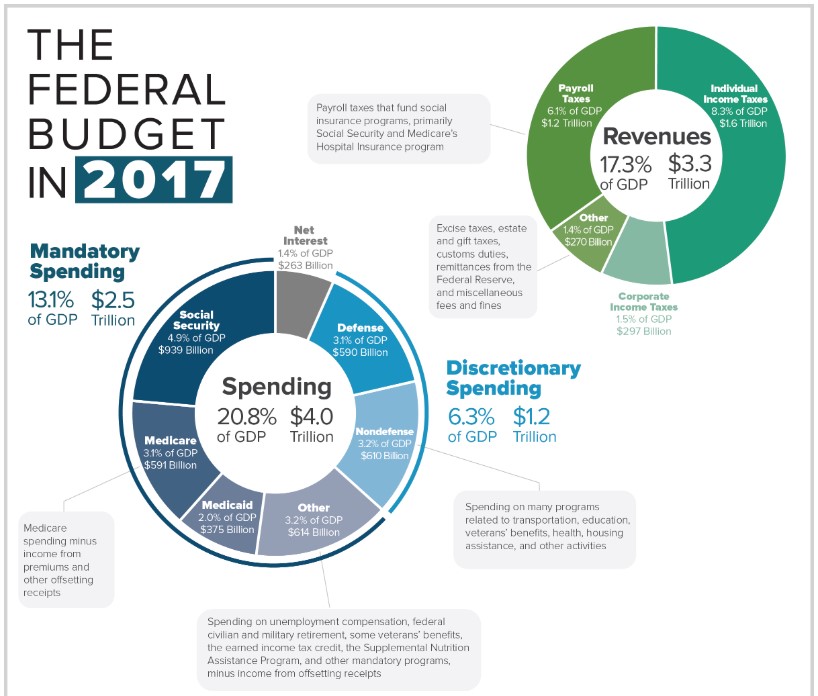

The facts about taxes and spending are different, of course, but this kind of disclosure shows us part of the way forward. The Congressional Budget Office already breaks down the budget in a readable infographic that is available on their website. Below, you’ll see the version from 2017 (the full-sized version is available here.) The 2018 budget, available here, also lists broken down figures for 2017.

Combining these things could present taxpayers a better understanding of how Congress is spending their money. Taxpayers know how much they pay in taxes only if they scrutinize their tax returns, which many people don’t really do. The number that concerns us every April is how much we still owe or how much we’re getting back.

But the total tax figure is really more important in the long run: it’s the true measure of how much Uncle Sam took from your paycheck. At a minimum, the new notice issued should include that figure in black and white. Even better would be a comparison of that figure with what you paid the year before.

The $2.96 trillion in income and payroll taxes was collected across 150,690,787 income tax returns, giving us an average per-person tax bill of $19,642. That figure is not particularly useful, since the taxes are disproportionately paid by upper-income people, but it’s good enough for an example of how the information should be disclosed. So let’s apply a hypothetical total tax bill of $19,642 to the federal budget and show people where that money went.

Based on that figure, the distribution of spending looks like this:

That breaks things down pretty far, showing the spending by each cabinet department or major independent agency. It could go farther. We could show each program the government pays for, but that would lead to a book-sized publication that would be just as easily ignored as the phone books that still get delivered to our houses every year. This strikes the balance between completeness and accessibility.

A simple, one-page chart delivered to the home of every American taxpayer would truly enlighten people about the government’s use of their money. With six months’ lead time to prepare the document, the government could have it in the people’s hands by October 15. That would give them plenty of time to read and analyze it before the elections in November. And since Congress loves an awkward backronym, they could call it the Transparency and Accountability eXplanation Act—or TAX Act, for short.

The TAX Act is a conservative measure, but it should also find support with anyone who believes in government openness and transparency. In a republic, the people rule themselves, but too often they do so with incomplete information. Give the people the information in a clean, unbiased presentation, and let them decide how they wish to be governed. Full disclosure of what Congress is doing with our money will make for a better-governed American nation.

Comments are closed.